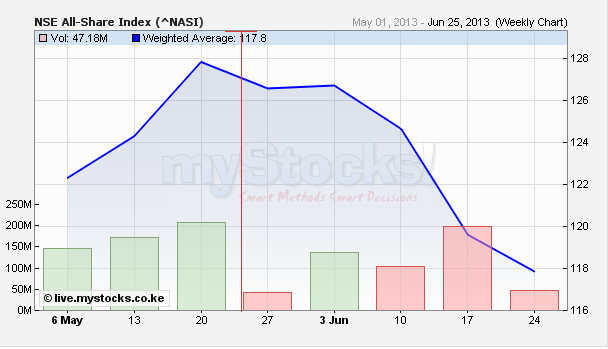

With little activity on the Nairobi Securities Exchange in 2013 regarding the IPO Market except the listing of Home Afrika on GEMS, will the NSE match-up to its counterparts read Wallstreet and European markets that predict 2014 as the major IPO Year? I tweeted about it over lunch to one reply so far.

Royal media services”@MrEricWainaina: 2014 NSE IPO ideas Brookside CBA Seven Seas Technologies S”

— Lord Lannister (@jamocaesar) December 17, 2013

My IPO ideas are based solely on the need to boost volatility at the bourse which has been at record highs this year. Here are a few crazy suggestions

The milk processing firm has been on a major buying spree targeting its competitors in the market. With plans to venture into the Nigerian market and a planned acquisition of milk processing firm in Ethiopia, an IPO to finance these expansion activities would be timely. The firm would make a good buy seeing that diary product consumption should rise 25% by 2025 in emerging markets alone.

Since the launch of M-shwari in collaboration with Safaricom, the bank rates highly in terms of customers and this off course translates into revenue. Listing would definitely see more liquidity on the bourse

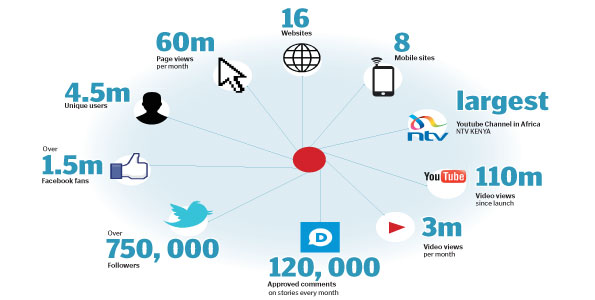

With its stations rating highly in terms of listeners, nothing seems impossible for Royal Media. Listing would definitely offer the firm access to capital for expansion activities which includes launching its Newspaper line and expanding to East African Markets. As a close, they need to invest in a digital division.

With the acquisition of Access Kenya by Dimension Data, the other probable ICT Firm that could list is Seven Seas Technologies. Its got the growth to show for it, the leadership and the hunger to expand into a Pan-African company.